- May 18, 2021

- Posted by: TeamSCK

- Category: Economics

Notified by CBIC on 1st May, 21

CBIC has issued certain notifications on 1st May, 2021 to provide some relaxations in GST due to COVID pandemic situation in our country. The synopsis of the notifications is as under:-

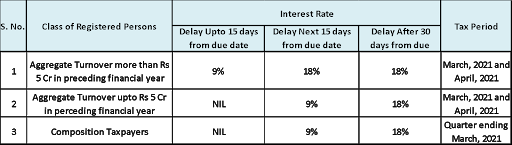

1) Relaxation in the Interest Rate – Notification No. 08/2021 – Central Tax, 01/2021 – Integrated Tax, 01/2021 – Union Territory Tax effective from 18th April, 2021:

Relaxation for those who have to file GSTR 3B and also to CMP -08 Composition dealers.

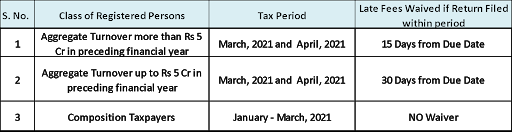

2) Waiver of the Late Fees – Notification No. 09/2021 – Central Tax effective from 20th April, 2021:

3)Extended Due date of GSTR 4 – Notification No. 10/2021- Central Tax effective from 30th April, 2021 :

CBIC extends due date for filing GSTR 4 in case of Annual Return for person opted for Composition Scheme for the financial year 31st March, 2021 from actual due date 30th April 2021 to 31st day of May, 2021.

4)Extended Due Date of FORM ITC 04 – Notification No. 11/2021- Central Tax effective from 25th April, 2021 :

CBIC extends due date for filing GST ITC-04 to 31st May 2021 In respect of goods dispatched to a Job Worker or received from a job worker, during the period from 1st January, 2021 to 31st March, 2021.

5)Extended Due Date of GSTR 1 – Notification No. 12/2021- Central Tax & 13/2021- Central Tax effective from 1st May, 2021:

| S.NO | GST Form | Tax Period | Actual Due Date | Extended Due Date |

| 1 | GSTR1 | April,2021 | 11th May 21 | 26th May 21 |

6)Relaxation in Availment of ITC – Notification No. 13/2021 – Central Tax effective from 1st May, 2021:

- Rule 36(4) shall apply cumulatively for the period April and May, 2021 and the return in FORM GSTR-3B for the tax period May, 2021 shall be furnished with the cumulative adjustment of input tax credit for the said months.

- Further, as per new proviso to rule 59(2), For the tax period April, 2021, a registered person may furnish such details, using Invoice Furnishing Facility (IFF) from 1st May, 2021 till 28th May, 2021.

7)Relaxations for other Proceedings – Notification No. 14/2021- Central Tax effective from 15th May, 2021:

(a) CBIC also provides relaxations in timeline for other proceedings falling between 15th April to 30th May extending the timeline to 31st May2021

- filing of any appeal, reply or application or furnishing of any report, document, return, statement or such other record, and

- for completion of any proceeding or passing of any order or issuance of any notice, intimation, notification, sanction or approval or such other action.

(b) In cases where a notice has been issued for rejection of refund claim, in full or in part and where the time limit for issuance of order in terms of the provisions of sub-section (5), read with sub-section (7) of section 54 of the said Act falls during the period from 15 April 2021 to 30 May 2021, in such cases the time limit for issuance of the said order shall be extended to 15 days after the receipt of reply to the notice from the registered person or the 31 May 2021, whichever is later.

[For details, please CLICK HERE to access the Notifications issued in this regard, which shall have force of law.]