- January 5, 2022

- Posted by: TeamSCK

- Category: Uncategorized

No Comments

- In order to file application for revocation of cancellation of registration and for GST refund, Aadhar authentication has been made mandatory.

- E-commerce Operators shall now be liable to pay tax on restaurant services [as under section 9(5) of the CGST Act] and hence, no tax shall be collected by such ECOs under section 52 of CGST Act.

- The scope of ‘Supply’ has widened to include activities or transactions by a person, other than an individual, to its members or constituents or vice versa, for cash, deferred payment or any other valuable consideration.

- A Registered person can not longer claim 5% provisional ITC. A registered person shall be eligible to claim Input Tax Credit only when the details of invoices and debit notes have been furnished by the supplier in GSTR 1 and the same reflects in GSTR 2A.

- GSTR 1 cannot be filed, if the GSTR 3B of previous month has not been filed.

- As per the amendment made to Section 107, no appeal can be filed by an aggrieved person under section 129(3), unless 25% of the penalty has been paid by the appellant.

- The power of commissioner to provisionally attach property or bank account as under section 83, is now widened.

- Amended section 130 provides that in case of confiscation of goods or services authorised under this Act, aggregate fine and penalty leviable under sub section (2) of Section 130 shall not be less than 100% of tax payable on such goods.

- For the purpose of recovery under section 79 of CGST Act, self-assessment tax shall include liability declared in GSTR-1 but not declared in GSTR-3B. Therefore, if supplier has declared liability in GSTR-1 and same is not paid, proper officer can initiate demand and recovery proceedings under section 79 of the Act.

- Section 151 of the CGST Act is substituted to provide power to the Commissioner or any other person authorised by him to direct any person to furnish the required information.

- GST Rate changes proposed for textile sector are put on hold.

- GST rates (12%) on footwear products are applicable from 1st January 2022.

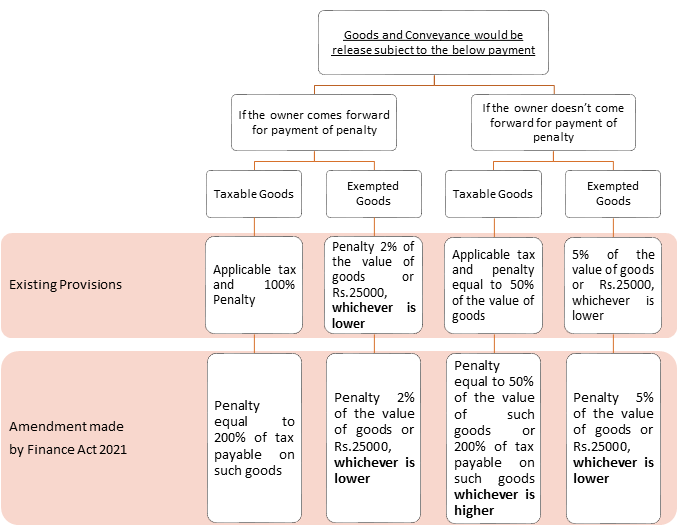

- Under section 129 (Detention, Seizure and release of Goods and conveyances in Transit) of the CGST Act, amount of penalty has changed as follows:

1 - 0